curated news excerpts & citations

Business Insider: America’s economy is ‘driving through the fog’

The decline of economic data could end up with a lot of unemployed workers and increase the chance of recession

…

For people who rely on the BLS, the past year has raised acute concerns. The first was President Donald Trump’s firing of BLS Commissioner Erika McEntarfer in July. Revisions to that month’s jobs report showed that the US had created far fewer jobs than initially reported in the previous two months. Revisions are a standard part of the BLS data collection process, and the size of the adjustments was well within historical norms. Economists warned that the firing could be a harbinger of political meddling in the crucial job and price figures. Jed Kolko, a senior fellow at the Petersen Institute for International Economics, called the firing a “five-alarm intentional harm to the integrity of US economic data and the entire statistical system.” Skanda Amarnath, Executive Director of Employ America, a think tank, said, “public trust is permanently harmed when the BLS commissioner is fired after one bad jobs report.”

(Business Insider more…)

Paul Krugman: Kevin Warsh and Weathervane Economics

WSJ: U.S. Manufacturing Is in Retreat and Trump’s Tariffs Aren’t Helping

Levies on imports were supposed to bring back a golden age of U.S. manufacturing. They haven’t worked, so far.

James Eagle: Central bank balance sheets are no longer temporary

…

This matters because size changes behaviour. When central banks hold large portions of government bond markets, their actions influence yields, liquidity and risk appetite even when policy rates are unchanged. Balance sheets become an active policy channel rather than a background detail.

-

Liz Dye: DOJ Attacks Judge, Claims Judicial Immunity For Itself

…

The least weird thing about this is that Mizelle (theoretically?) left the DOJ last year to become general counsel at the Department of Homeland Security. Kristi Noem’s crackpot legal memos aren’t gonna write themselves!Serving as a federal prosecutor was once a prestigious position, open only to high achievers with strong academic and professional records. Now the agency’s reputation is in shambles, it’s bleeding experienced lawyers, and they’re so desperate for bodies they’re begging randos to slide into their DMs. And it shows!

(Liz Dye more…)Steve Vladeck: The Justice Department Beclowns Itself (Again)

…

In other words, after filing an unprecedented complaint against a sitting federal judge, making a big public stink about it (which, by the way, was itself a violation of the law), and having its complaint invoked as one of the grounds for the proposed impeachment charges against Chief Judge Boasberg, DOJ … never followed through. It turns out, it was never about adjudicating Boasberg’s behavior; it was about making splashy headlines and fueling right-wing attacks on the judiciary without regard to whether DOJ’s specious charges would withstand meaningful scrutiny.

(Steve Vladeck more…)

-

Noah Berlatsky: Not All White Supremacists Are White

On race and the CBP agents who shot Alex Pretti

…In more than one essay, James Baldwin discusses the process by which waves of European immigrants to the US ceased to be Greeks, or Italians, or Norwegians, or Russians, or Irish, and became white. Baldwin refers to this as “the price of the ticket”—you forswear your history and heritage, including often the experience of discrimination, and in return you get to be a white American defined not by your past, but by your (supposed) superiority to and (very real) power over Black people.

(Noah Berlatsky more…)

-

Brian Beutler: The Goal Must Be Removal

Putting all eggs in the basket of winning elections is a dangerous decision, when Trump’s plan is to cheat in those elections.

-

Ken Klippenstein: Feds Identify “Leader of Antifa”

Twenty-nine year old Chandler Patey has been regularly protesting outside his local ICE facility in South Portland for months, offering up his apartment to fellow protesters to use the bathroom or wash off pepper spray, according to local news.

To the Department of Homeland Security, “he is the leader of Antifa in Portland, OR.”

That phrase appears in an internal report produced by DHS, the largest law enforcement agency in the country. As they see it, Patey—a young man accused of no crime and who looks like a random protester plucked off the streets of Minneapolis—is a domestic terrorist.

(Ken Klippenstein more…)

-

Marisa Kabas: What it’s like to see ICE tear gas kids

Attendees at a Portland, OR protest describe a vicious, unprovoked and sudden attack

…Just moments before, a procession of thousands flowed through the streets of Portland’s South Waterfront neighborhood. It was an event organized by a coalition of labor unions that began with speeches at Elizabeth Caruthers Park and culminated in a march just down the street past the local ICE building. The plan was to keep the procession moving, but when some marchers crossed a no trespassing line in front of the building, federal officers reacted with immediate violence. The response revealed ICE and other related agency’s feelings: that they are at war, and the people are the enemy.

(Marisa Kabas more…)

-

404 Media: Our Zine About ICE Surveillance Is Here

We are very proud to present 404 Media’s zine on the surveillance technology used by Immigrations and Customs Enforcement. While we have always covered surveillance and privacy, for the last year, you may have noticed that we have spent an outsized amount of our attention and time reporting on the ways technology companies are powering Donald Trump’s deportation raids.

-

Joyce Vance: All My Mornings Are Mondays —

Stuck in an endless February, even though it’s only day two

…We are still in a partial government shutdown. …

(Joyce Vance more…)

-

Rebecca Solnit: When Love Thy Neighbor Is a Cry of Resistance

…

I don’t think we’ll get to peace and stability anytime soon, but I do believe they are losing, if thrashing violently on the way down (I cited better authorities than me on that question of losing in the essay Weak Violence, Strong Peace). In the most practical sense, the open cruelty and corruption, the lies and destruction, are driving people into the arms of the opposition (may we not drive them away ourselves).And they are losing the culture wars, though that’s not news. …

(Rebecca Solnit more…)Nate Silver: Don’t discount American democracy’s resilience

People’s World: Union leader Taylor Rehmet scores major Texas win

Dean Obeidallah: This 3-page court opinion releasing Liam Ramos is one of the best ever written!

-

Bill McKibben: Thinking about lying

Climate denial taught our leaders shamelessness

…Where the GOP learned to lie as a matter of course is an interesting question, and I’m afraid I’ve had a front row seat. I think it’s the climate fight, more than anything else, that taught them to regard reality as optional. And I think this because I remember the start of it all. When Jim Hansen first testified before the Senate that global warming was real, it caused a society-wide stir; running for the White House, the sitting vice-president George Herbert Walker Bush said he would combat the greenhouse effect with “the White House effect.” He made no attempt to deny it, or pretend it wasn’t a problem; it was reality, he wanted to lead the world, he had to at least pretend to deal with it.

(Bill McKibben more…)

-

AlterNet: Trump’s lawsuit against the Pulitzer Prize Board backfires with latest subpoenas

-

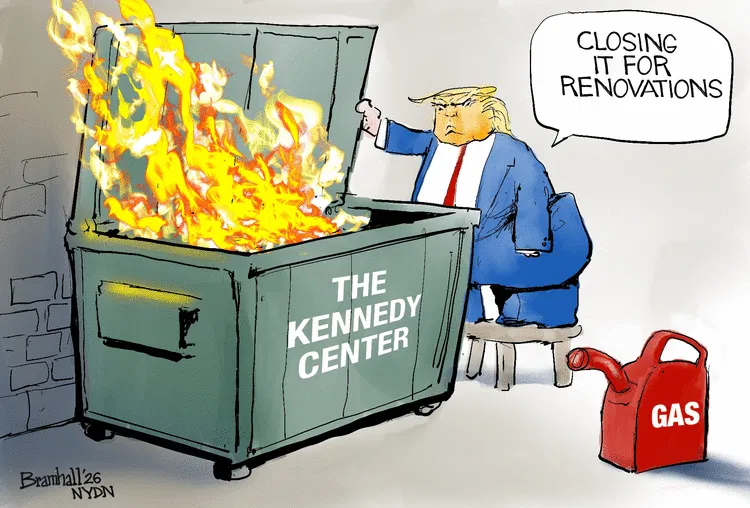

IndieWire: Every Documentary Filmmaker Should Be Worried About the Success of ‘Melania’

The film is the latest streamer-funded, carefully choreographed, boring, celebrity puff piece being branded as a documentary. It’s also a harbinger of what sorts of “true stories” are being championed these days.

Slate: Melania’s Box Office Shows That the First Lady Has Entered Her Flop Era

Third-place opening weekends are not usually the stuff of box-office headlines, but on Saturday, you couldn’t pick up your phone without reading that Melania, Brett Ratner’s gauzy, glad-handing portrait of the first lady, was doing much better than expected. Deadline called its opening the strongest for a documentary in a decade, and the New York Times wrote that its $8 million opening was 60 percent above industry predictions. By Sunday, however, the latter number had been revised drastically downward, from $8 million to barely over $7 million, and as for the former statistic, it only holds if you don’t categorize concert movies as nonfiction, since it’s nowhere in the ballpark of The Eras Tour’s $123 million.

-

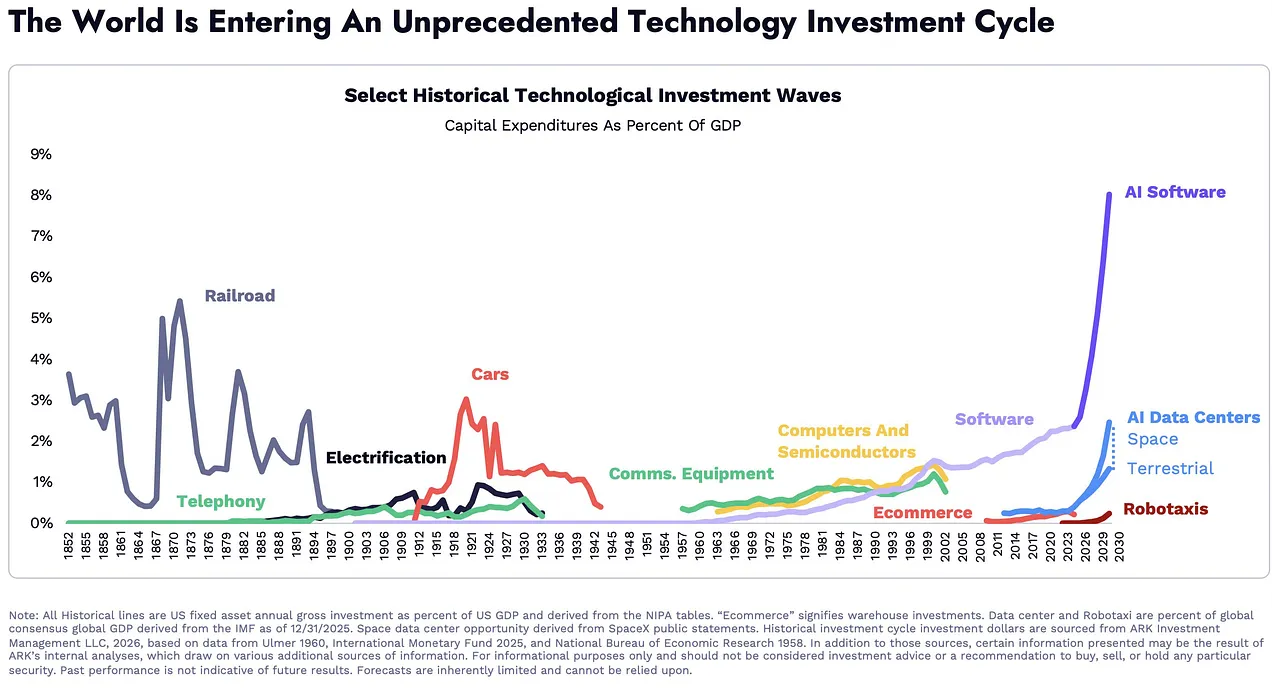

James Eagle: The AI investment cycle is becoming infrastructure

(James Eagle more…)

ICE deaths 2026 – They deserve remembrance and justice.- January 24: Alex Pretti

- January 14: Heber Sanchaz Dominguez

- January 14: Victor Manuel Diaz

- January 9: Parady La

- January 7: Renée Good

- January 6: Luis Beltran Yanez-Cruz

- January 5: Luis Gustavo Nunez Caceres

- January 3: Geraldo Lunas Campos

- December 31, 2025: Keith Porter

Walk for Peace – Dhammacetiya – The Ancient Sacred Buddhist Scripture Stupas

Margaret Chase Smith: Declaration of Conscience

NPR: January 6, 2021: A visual archive

Accountability Initiative ICE List

GriftMatrix

Trump Action Tracker

Timeline: Tracking the Trump Justice Department’s Anti-Voting Shift

Tracking the Lawsuits Against Trump’s Agenda

Trump Pardons Database

Project 2025 Tracker

DOGE Tracker

ProPublica: Elon Musk’s Demolition Crew

Wired: 6 Tools for Tracking the Trump Administration’s Attacks on Civil Liberties

Leave a Reply